Amur Capital Management Corporation Things To Know Before You Buy

Amur Capital Management Corporation Things To Know Before You Buy

Blog Article

Some Known Incorrect Statements About Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation Can Be Fun For EveryoneThe 2-Minute Rule for Amur Capital Management CorporationThe Main Principles Of Amur Capital Management Corporation The Ultimate Guide To Amur Capital Management CorporationAmur Capital Management Corporation Things To Know Before You BuyThe 5-Minute Rule for Amur Capital Management Corporation

The companies we comply with need a solid track record normally at least one decade of running background. This indicates that the business is likely to have faced a minimum of one economic recession and that management has experience with misfortune as well as success. We seek to omit companies that have a debt quality below financial investment quality and weak nancial strength.A business's capability to increase dividends regularly can demonstrate protability. Business that have excess money ow and solid nancial positions typically choose to pay dividends to bring in and reward their investors. Consequently, they're frequently less volatile than supplies that don't pay rewards. Yet beware of grabbing high returns.

Things about Amur Capital Management Corporation

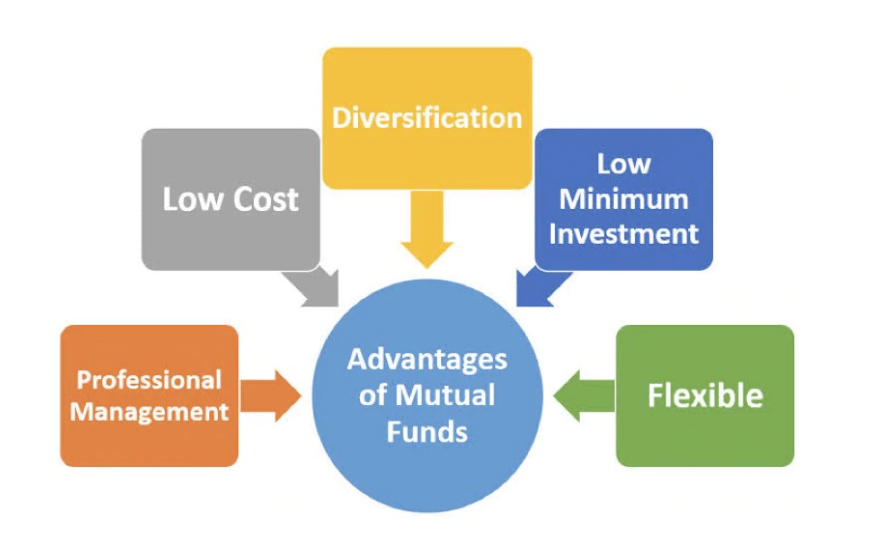

Diversifying your investment profile can help protect against market uctuation. Look at the size of a firm (or its market capitalization) and its geographical market United state, industrialized worldwide or emerging market.

Regardless of just how very easy electronic investment management platforms have actually made investing, it should not be something you do on a whim. In reality, if you make a decision to go into the investing world, one point to take into consideration is for how long you actually wish to spend for, and whether you're prepared to be in it for the lengthy haul.

There's a phrase common connected with investing which goes something along the lines of: 'the round may drop, but you'll want to make sure you're there for the bounce'. Market volatility, when economic markets are going up and down, is an usual phenomenon, and long-term might be something to help smooth out market bumps.

Amur Capital Management Corporation Can Be Fun For Anyone

Joe spends 10,000 and earns 5% returns on this investment. In year 2, Joe makes a return of 525, because not just has he made a return on his preliminary 10,000, yet also on the 500 invested returns he has gained in the previous year.

The Ultimate Guide To Amur Capital Management Corporation

One means you can do this is by getting a Supplies and Shares ISA. With a Stocks and Shares ISA. passive income, you can spend approximately 20,000 each year in 2024/25 (though this undergoes change in future years), and you do not pay tax on any returns you make

Starting with an ISA is truly simple. With robo-investing systems, like Wealthify, the effort is provided for you and all you need to do is pick just how much to invest and select the risk degree that suits you. It might be among the few instances in life where a less emotional approach can be helpful, yet when it pertains to your financial resources, you could wish to listen to you head and not your heart.

Remaining concentrated on your long-lasting objectives can assist you to stay clear of unreasonable choices based on your emotions at the time of a market dip. The stats don't lie, and long-term investing can come with lots of benefits. With a made up technique and a lasting investment technique, you can possibly expand even the tiniest quantity of financial savings right into a decent sum of money. The tax treatment depends upon your specific scenarios and may undergo alter in the future.

Amur Capital Management Corporation Fundamentals Explained

Investing goes one action even more, aiding you attain individual objectives with three substantial advantages. While conserving ways alloting part of today's money for tomorrow, spending means putting your cash to function to possibly gain a better return over the longer term - passive income. https://www.huntingnet.com/forum/members/amurcapitalmc.html. Different classes of investment possessions money, fixed passion, property and shares typically generate different degrees of return (which is family member to the risk of the financial investment)

As you can see 'Development' properties, such as shares and home, have traditionally had the very best general returns of all property courses however have likewise had bigger peaks and troughs. As a capitalist, there is the prospective to earn capital development over the longer term as well as a continuous earnings return (like returns from shares or lease from a property).

More About Amur Capital Management Corporation

Inflation is the recurring rise in the expense of living over time, and it can influence on our economic health and wellbeing. One means to help outpace inflation - and create favorable 'actual' returns over the longer term - is by purchasing possessions that are not just efficient in supplying higher revenue returns yet additionally offer the potential for resources growth.

Report this page